Commerical Lending

Commercial mortgages are somewhat similar to conventional residential mortgages, except that the loan is secured against commercial property.

Commercial mortgages also have a higher rate of interest than a regular residential mortgage and a lower loan-to-value. The reason is that commercial mortgages usually pose a more significant risk to the Lender.

The foregoing comments relate to obtaining your commercial mortgage approval through an institutional lender. In some cases, however, the application may not meet all the lending guidelines of an institution and we would then be considered a "B" or private lender.

The approval criteria are less strict with these lenders and, providing you have sufficient equity in the property, we can generally find you the financing. As of late, we are finding that the Banks are becoming increasingly less interested in commercial mortgages in the $250,000 to $1,000,000 range. We have several private lenders that will do this type of financing.

The main factor in getting financing for you is that you have good equity in your property, and the investment property has good income, enough for it to cover it's mortgage and expenses by at least 1.2 times. It should be noted, however, that fees for arranging commercial financing, whether institutional or private, are the responsibility of the borrower. Fees vary depending on the degree of difficulty and complexity of the deal. We will always work with the Lender, however, to negotiate fees on your behalf.

Key factors considered:

1. Credit rating of Principal 2. The Appraisal and the Economic Market Value

3. The Income and Expenses of the Commercial Property

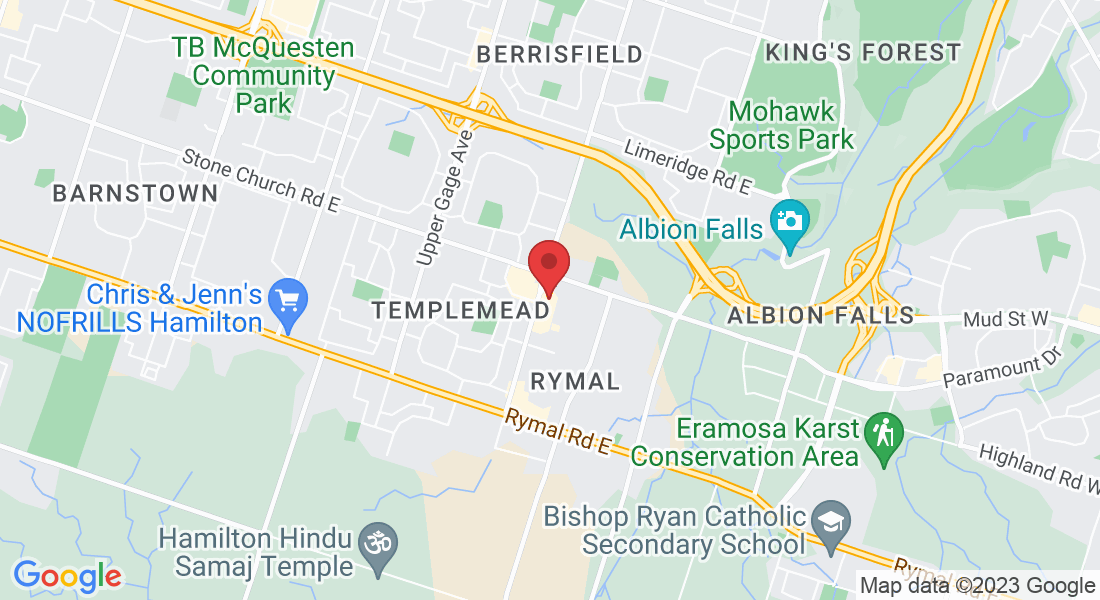

4. The location of the property

5. The Type of Commercial property, ie, multi-unit property, strip plaza, mixed use property, etc